XM Profit & Loss Calculator

Contents:

The fractional pip, or Pipette, always follows the pip location, so it would be in the 5th and 3rd decimals respectively. XM offers a wide range of products for customers to choose from. In addition to Forex, XM also has CFDs and stock indices, commodities, stocks, metals, energy from the same trading account, including XM Micro account and XM standard account. All are transparent and transparent from spreads to commissions with no hidden fees and orders are executed quickly in less than 1 second.

All you need is your base currency, the currency pair you are trading on, the exchange rate and your position size in order to calculate the value of a pip. The Margin Calculator will help you calculate easily the required margin for your position, based on your account currency, the currency pair you wish to trade, your leverage and trade size. In this field there’s also the option of calculating the pip value based on the lots traded, or, the units traded.

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-5rvp3BCShLEaFwt6.jpeg

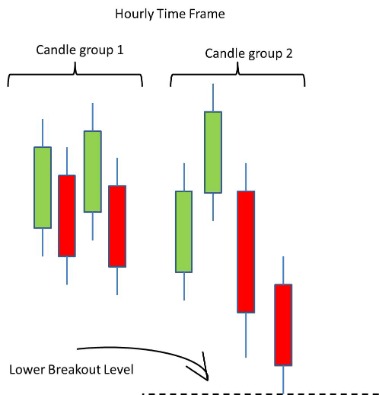

Below you will find several forex calculators to help you make trading decisions during your forex trading. Values are calculated in real-time with current market prices to provide you with an accurate result. In most forex currency pairs, one pip is on the 4th decimal place of the Forex pair (0.0001), meaning it’s equivalent to 1/100 of 1%.

Pip calculators explained

However, traders should know that spread is not the ultimate factor to decide whether a broker is good or bad. If you trade 0.01 lot , which is the minimum trading unit of XM, you will have a profit and loss of 10 yen per 1 pips. Let’s see how to calculate how much XM’s pip profit and loss will be. The idea of the calculation method is that profit and loss can be calculated based on how much currency quantity was traded at 1 pip.

Use our Pip Value Calculator to accurately calculate the pip value for forex pairs, indices, crypto currencies, and more, using live market quotes, account base currency, lot size and traded pair. Variable spreads will not be controlled by the forex brokers but they are always changing and is usually provided by ECN, STP or Non-dealing desk. This is because the exchange will receive the exchange rate of the current currency pair from the liquidity providers themselves, and notify this price to traders without any intervention. Thus, the brokers will not control spread, the whole price difference or fluctuation will depend on the general fluctuations of the market.

Chat trực tiếp XM

If fixed spread is usually provided by Dealing Desk or Market Maker House, then floating spread will be provided by STP and ECN platforms or No Dealing Desk.

FXTM Trading Tools Profit Calculator – FXTM

FXTM Trading Tools Profit Calculator.

Posted: Mon, 14 May 2018 16:28:33 GMT [source]

How to start using Aximtrade’s Infinite Leverage account? See the conditions and more about leveraged Forex trading here. Our tools and calculators are developed and built to help the trading community to better understand the particulars that can affect their account balance and to help them on their overall trading. For JPY pairs, one pip is on the 2nd decimal place of the Forex pair. For pairs without JPY, one pipette is on the 5th decimal place of the Forex pair. Trading forex is risky and you may lose all your capital.

What are pips?

In addition to the standard pip, most forex brokers also offer ‘fractional pip pricing’. This adds a fifth decimal place, so a fractional pip is one tenth of a pip. Fractional pips can allow for tighter spreads, and give a better understanding of a currency price’s movements. The leverage calculator will calculate the required leverage to open your trading position based on your account currency, the traded currency pair and trade size.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

One of them is a tool that calculates pips, so please take advantage of it. Calculate currency conversion in real time with our free currency converter. Convert major or minor currencies and precious metals. An alternative Alpari website offers services that are better suited to your location. Find out more in the Regulations section of our FAQs.

I hope that my articles about forex brokers can help you succeed in this market just like me. XM is the only broker who offers the best bonuses and rebate compared to other top brokers. When you first register an account in XM, you can instantly claim a 30-dollar welcome bonus from XM.

How to get HYCM’s Welcome Bonus and Cashback on Cryptocurrency Deposit HYCM offers a 10% welcome bonus and 2.5% cashback when depositing in cryptocurrencies. I was devastated and depressed losing money to some fake MT5 broker who stole about $550,000 USDT from me and I was denied withdrawal of my funds as well as my profits. I became sad knowing fully well I’ve been cheated so I was referred to the best fund retrieval at CRYPTOREVERSAL gmail|[]c0m through my friend. This tech genius was able to recover my funds within 15 hours I hired him. He’s the real deal to contact if you got any crypto tech issues ranging from stolen funds, missing funds and retrieval of crypto asset account passwords. Exinity Limited is a member of Financial Commission, an international organization engaged in a resolution of disputes within the financial services industry in the Forex market.

XM, Beginners Guide: How to Calculate “Pip Value”, the Formula & Examples

Our all-in-one xm pip calculator enables you to calculate the required margin, pip value and swaps based on the instrument, as well as the leverage and the size of the position. There are not many brokers that can offer this type of bonus. Because at XM, you can withdraw all of the bonus profit. Clients can withdraw bonus profit, so it costs brokers a lot of money. Our profit and loss calculator helps you evaluate the projected profit or loss from any transaction you intend to make in the forex market.

Long term investors don’t care about spreads much because they open just a small number of orders each year but those are extremely high volume orders. So for them, the spread rate ranging from 1 to 2 pips is acceptable. They only care about the broker’s credibility, quotes quality, and swap. On the other hand, when it comes to scalpers, they do care about spreads. However, spread should not be the only thing to pay attention. A lot of things contribute to the total trading cost of a broker, so I would like to recommend a broker that has reasonable trading cost and is one of the top largest forex brokers.

FXTM Review 2023: Is This Broker Platform Safe for Trading? – CryptoNewsZ

FXTM Review 2023: Is This Broker Platform Safe for Trading?.

Posted: Tue, 14 Mar 2023 07:00:00 GMT [source]

78.17https://g-markets.net/ investor accounts lose money when trading CFDs with this provider. For currency pairs denominated in foreign currencies, even if you trade with the same currency volume, the rate of each currency is different, so the profit and loss per 1 pip of XM is different. Once you select your account currency and the trade size, the calculator will calculate the pip value with Standard, Mini and Micro lots with the current market rates. A pip is the smallest price change in a currency pair in Forex. Over the years, Forex brokers introduced fractional pips or ‘Pipettes’ to offer traders better bid and ask prices while trading, which are actually a smaller part of a pip.

The articles on this website are only the personal opinion of the author. The author does not encourage readers to follow and do not assume any responsibility for the content on the website. With our all-in-one calculator you can calculate the required margin, pip value and swaps.

We are currently working with many well-known experts in forex trading such as Mr. Fanara Filippo or Mr. Mario Draghi. We aim to offer readers a trusted, useful, and professional source of education about the best forex brokers in this market as well as other forex-related topics. XM spread and commission are similar to other best forex brokers. For swap, they charged the same amount as bank interests.