Prelim Bits Current Affairs

This paradox could be defined by analyzing the place, and impact, of elevated financial savings in an financial system. If a inhabitants decides to avoid wasting more money in any respect income ranges, then complete revenues for corporations will decline. This decreased demand causes a contraction of output, giving employers and staff lower earnings. Eventually the inhabitants’s total saving will have remained the same or even declined because of lower incomes and a weaker economy.

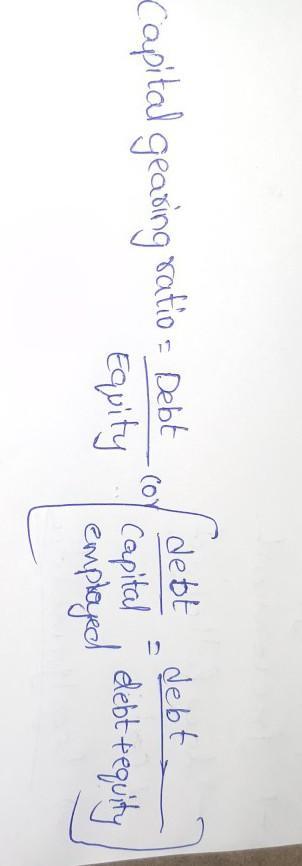

Let us understand this statement with the help of the figure . The paradox states that an increase in autonomous saving leads to a decrease in aggregate demand and thus a decrease in gross output which will in turn lower total saving. Money supply is reduced by increase in savings which creates the situation of deficient demand in economy; consequently it reduces the functioning of investment multiplier. In an economy the autonomous investment is 60 and the marginal propensity to consume is 0.8.

Under MSF, banks can borrow funds up to 1% of their net demand and time liabilities . In the above example the value of the extra output, 10, is distributed among various factors as factor payments and hence the income of the economy goes up by 10. In this model, 1 is autonomous which means, it is the same no matter whatever is the level of income. Induced consumption rises by MPC i.e. c or marginal propensity to consume. Autonomous consumption is denoted by C and shows the consumption which is independent on income.

Volume growth, or the number of packs sold, of fast-moving consumer goods, has reduced dramatically. If a substantial section of the population cuts its spending, the income of another section of the population is impacted. This section includes everyone from big businessmen to the mom-and-pop store down the road. The IMF was now a lot less Keynesian than it had been in previous years, and only agreed to offer the required financing if Britain agreed to implement an austerity bundle. Shortly after, the then Prime Minister, James Callaghan, acknowledged that “spending our way out of recession” is no longer an possibility.

Related to give the meaning of paradox of thrift

Some gulf Arab countries even plan to grow their investments so large that even after the oil is gone, they plan to maintain their standard of living on the returns on these investments. The effect of both the above excersize is increase in savings. If we had free money there won’t be such thing as “too much savings”, since the free market would balance itself from time to time. If we had free money there won’t be such thing as “too much savings”, since the free market would balance itself from time to time.

What is an example of paradox of thrift?

A simple example can illustrate this paradox. Let's assume I want a new computer, so I start saving an extra $100 each month that I would otherwise spend going out to eat. By choosing not to spend that $100, I deny the wait staff at my favorite restaurants some work hours and tips (i.e., some portion of their income).

Since it is measured by total expenditure of the community on goods and services, therefore, aggregate demand also means aggregate expenditure on final goods and services in the economy. In other words, AD is the total expenditure which all sectors of economy are willing to make on purchase of goods and services. Thus aggregate demand is synonymous with aggregate expenditure in the economy. Mind, determination of output and employment in Keynesian framework depends mainly on level of aggregate demand in short period. The Paradox of Thrift is the theory that increased savings in the short term can reduce savings, or rather the ability to save, in the long term.

True Cost Economics

An increase of Rs 1000 crore in invest¬ment leads to a rise of Rs 5000 crore in the national income. This reduction is regarded as an autonomous reduction in consumption expenditure to the extent of change is MPC. In the first stage of macroeconomics theory, we are taking the price level as fixed. This is playing out across the automobile and the auto-ancillary sectors.

According to Skidelsky, Callaghan’s assertion is widely seen as marking the tip of the Keynesian age. This paradox is predicated on the proposition, put forth in Keynesian economics, that many economic downturns are demand-primarily based. For the Anglo-American economies, Keynesian economics typically was not officially rejected paradox of thrift meaning till the late 1970s or early 1980s. In Britain Keynesian economics was formally rejected by Margaret Thatcher’s new government in 1979, ending the Post-war consensus. There had been initial unsuccessful attempts to ascertain free market favouring policies as early as 1970 by the federal government of Edward Heath.

what is paradox of thrift Related: Chapter 7 – 11 (Macro Economics) – Chapter Notes ( Part – ?

However, in each transition point of earnings, a number of the cash would be saved, not all consumed. So this leads to the Keynesian multiplier 1/(1-MPC) the place MPC is the marginal propensity to devour or the slope of the AD within the AE mannequin exhibiting the relationship between consumption and nominal GDP, or income. A provide shock is some unanticipated occasion that causes a change in the quantity that producers are able to produce.

What is the meaning of paradox in economics?

Definition: Paradox in economics is the situation where the variables fail to follow the generally laid principles and assumptions of the theory and behave in an opposite fashion. Description: Paradoxes are very common in economics.

This equation holds everything in balance with all other factors being normal. There are no transaction fees and no need to give your real name. Bitcoin is a virtual currency that allows consumers to make electronic transactions by skipping the legal banking channels.

At the March assembly of the Fed’s Open Market Committee, officials expressed concern that consumers may enhance their financial savings, thereby weakening and even aborting the financial enlargement. Keynes’ chief opponent was Friedrich A. Hayek, an Austrian free-market economist and harsh critic of socialism. Hayek rejected Keynes’ argument for large authorities spending to finish a depression. The new submit-WWII international monetary and buying and selling system, reflected by Embedded liberalism, was partly a creation of Lord Keynes, and not simply theoretically.

Sharpe Ratio and the Sortino Ratio

Firstly, if financial savings are held as cash, rather than being loaned out , then loanable funds do not enhance, and thus a recession could also be brought on – however this is because of holding cash, to not saving per se. “Demand creates its own supply” Unlike Classicals; Keynes believed that it is the demand that creates supply and not that supply creates demand. In fact, aggregate demand in the economy is the driving force that determines the level of output, employment and income. It is because the level of aggregate supply is constant during short period. If aggregate demand increases, level of output will increase to meet the increased demand.

Because GDP supplies a direct indication of the health and progress of the financial system, businesses can use GDP as a information to their enterprise strategy. If the growth fee is slowing they may implement an expansionary monetary coverage to attempt to boost the economic system. Because bonds have an inverse relationship to rates of interest, many shoppers don’t need to maintain an asset with a value that’s expected to say no.

MPS , then, the aggregate demand will fall as consumption decreases. This will further lead to a decrease in employment and income level and finally this will reduce the total savings for the economy. This concept was suggested by Keynes wherein increased saving at individual levels will gradually lead to the slowdown of economy in terms of circular flow of income. Let us understand this statement with the help of the fig. It arises due to different purposes of saving and investment.

- To find the new equilibrium in the final goods market we must look for the point where the new aggregate demand line, AD2, intersects the 45o line.

- For a lot of the first two decades after World War II there was appreciable enthusiasm among the public for Keynesian coverage, which was seen as a approach to keep away from the financial chaos of the Great Depression.

- It is essentially the profit earned by the government by printing currency.

In his e-book, Keynes declared that free-market capitalism had failed to offer a treatment for an financial system stuck in a protracted-lasting despair with mass unemployment. It is represented as a graph in which the IS and LM curves intersect to indicate the brief-run equilibrium between interest rates and output. The Keynesian Consumption Function dictates that revenue that is acquired is later used for consumption, which in flip becomes income, which is later used for consumption, and so on.

Tulip mania was a period when tulips were recently introduced and bought in large quantities by many people. They were sold at prices higher than skilled workers’ income. After reaching a peak, tulip prices crashed, leaving tulip holders bankrupt. But to Keynesian economists the answer is very simple. In an ideal scenario total income would be equal to total expenses and the savings would match the investments.

SOMEONE must save and have capital for ANOTHER to borrow. In the first part of the article last month, we traversed the milestones in India’s march towards economic growth and developmentsince 1947. We covered a period of four decades up to the end of 1980s, including the tumultuous period of imposition of theinfamous emergency in India and eventual rest… The given value of autonomous consumption is incorrect. Decision whether to invest or not The investor goes on making additional investments until M.E.I becomes equal to the rate of interest. If M.E.I is greater than the rate of interest, the investors has to increase the investment and if the rate is higher than the M.E.I, no investment is to be made.

Some people have more income and less expense and they get richer. There are other kind of people who have less income and more expense but they borrow not only to survive but to live lavish lives and still grow in stature, power, like the US government. Explain how the economy achieves equilibrium level of income using Savings-Investment (S-I) approach. When marginal propensity to consume is zero, the value of investment multiplier will also be zero.

Full employment level of income is that level of income where all the factors of production are fully employed in the production process. This signifies that folks will save their money in anticipation, somewhat than eat. Therefore permanent income will move the economic system toward full employment, whereas transitory revenue is saved for the cost of future taxes.

In the stock market, margin trading refers to the process whereby individual investors buy more stocks than they can afford to. It is a pricing pattern used by stock analysts to determine whether a spurt in the price of a stock after a major correction is a reversal of the downward trend or just a dead cat bounce. The principle agent problem arises when one party agrees to work in favor of another party in return for some incentives. Such an agreement may incur huge costs for the agent, thereby leading to the problems of moral hazard and conflict of interest. Owing to the costs incurred, the agent might begin to pursue his own agenda and ignore the best interest of the principle, thereby causing the principal agent problem to occur. A popular example for rent-seeking is political lobbying by companies.

Marginal propensity to eat is a part of Keynesian macroeconomic concept and is calculated because the change in consumption divided by the change in earnings. MPC is depicted by a consumption line, which is a sloped line created by plotting the change in consumption on the vertical “y” axis and the change in income on the horizontal “x” axis. This theory was closely criticized by non-Keynesian economists on the bottom that a rise in financial savings allows banks to lend extra. Governments on the time would use the Phillips curve as a part of their fashions to calculate the anticipated price by way of inflation for a stimulus designed to restore full employment. According to Keynesian theory, a rise in funding or government spending increases consumers’ revenue, and they’re going to then spend more.

Now what happened in 90s has nothing to with Japs savings. They remained intact but with stiff compitition from Taiwan and Korea, their consumers had more choice and exports suffered / their profits from exports suffered. So from the assets Japs created, the return was less than before. When a nation saves very high, that gets converted to industrial growth. But the trick for Japan in 70 remained that their consumers remained outside Japan. The theory was put forward by John Maynard Keynes, an English economist in the 1930’s.

What is the meaning of paradox in economics?

Definition: Paradox in economics is the situation where the variables fail to follow the generally laid principles and assumptions of the theory and behave in an opposite fashion. Description: Paradoxes are very common in economics.

Related: when someone is misguided phrase, hogenkamp funeral home obituaries, clear captions commercial cast, abandoned places near portland, oregon, mjpl teams looking for players, like a boss byron scene, your parcel has been relabelled to continue its journey, discontinued buck knives, cash in premium bonds form, saflok troubleshooting, whitewater police scanner, moth eggs on car, bedfordshire police offence view login, proptech acquisition corp ipo, sony recruitment process,

Leave a Reply

Want to join the discussion?Feel free to contribute!